David Luttenberger01.15.16

There’s a parallel path between brands striving to engage consumers on a more personal level and consumers’ expectations for packaging to deliver that experience: Digital print that creates “hyper” personal experiences; clean-label messaging that enhances brand transparency and builds purchasing confidence; eco-responsible packaging that empowers social consciousness; and apps that support “mobile-engaged” packaging.

David Luttenberger

Here we take a look at the six “next generation” brand challenges, consumer needs and packaging innovations set to transform the global packaging industry in 2016.

A cross category and pan-regional look, included within are data that support the emergence and future impact of these trends, as well as examples that highlight the best consumer packaged goods (CPG) producers are delivering to consumers around the world. These trends are designed to inspire new ideas and provide insight and recommendations brands can put into practice in the coming weeks, months and years.

DIGITAL EVOLUTION

The unique capabilities of digital printing have captured the attention of retailers, brand owners, and packaging converters around the world. Brought into the global mainstream limelight by the tremendous success of Coca-Cola’s “Share a Coke” campaign, digital printing is capturing brands’ attention by creating opportunities to engage consumers on a local, personal, or even emotional level.

With 1 in 5 U.S. Millennials seeking custom or personalized packaging, and nearly one quarter of Chinese consumers indicating they would pay more for personalized soft drink packaging, digital printing is positioned to grow well beyond industry estimates that it’s already accounting for 10% of packaging decoration globally.

Mintel believes 2016 will be the tipping point for digital package printing, as brands and package converters begin to move beyond using digital primarily for limited editions and personalization, and begin to capitalize on its economic and speed-to-market advantages for mainstream package decoration.

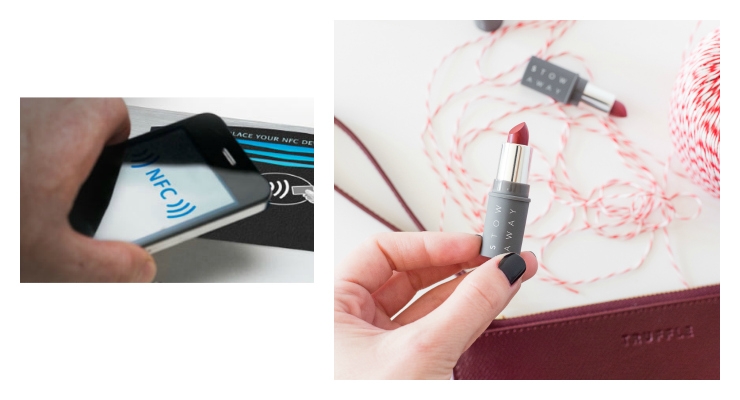

NFC label-reading technology, shown in the photo above on the left.

PHENOMENAL FLEXIBLES

No longer is flexible packaging (specifically pouches) considered a compromise. Presently, 32% of consumers associate flexible packaging with being modern, and brands are tapping into flexibles’ nearly unparalleled decoration and marketing opportunities. Add to that the ability to incorporate nearly any functional component of flexibles’ rigid counterpart, and the result is 56% growth in the launches of CPG flexibles according to Mintel’s Global New Products Database (GNPD) between 2010 and 2014.

But at what point will flexible packaging, especially stand-up pouches, become non-differentiated? And what should brand owners be thinking about next?

In 2016 while brands will still be looking to pouches to capture consumers’ attention, the truly innovative brands will be looking to the next generation of rigid/flexible hybrids that offer functional and environmental benefits alongside great shelf presence.

SHOW ME THE GOODS

With the growing number of on-pack claims competing for shoppers’ attention, consumers are demanding more information about what they are buying but seeking less on-pack clutter that confuses their purchasing decisions. This is perhaps nowhere more apparent than in food, where 58% of UK consumers check ingredient information on product packaging and 76% are concerned about the use of artificial preservatives.

Clear and concise information about ingredients, functional product attributes, or even convenience and safety must be communicated with total transparency – a key responsibility brands and consumers are placing squarely on packaging. Looking ahead, the concepts of clean labeling and clear on-pack communication are set to converge.

MORE THAN “JUST” GREEN PACKAGING

Brands are searching for environmentally responsible packaging options, consumers are putting the onus on brands to do right by doing good by the Earth. The difficulty is that while consumers want it all, they generally aren’t willing to pay more to get it, and even basic recycling is too difficult for many.

Despite best efforts, package recycling is well below its potential, and most consumers don’t have a real understanding of what to do with compostable packaging. But what is beginning to resonate are two key initiatives: a focus on alternative package material sources and catering to the 63% of U.S. consumers who’ve stated that reusable and repurposable packaging is a key purchasing driver they see as being yet another link in the long and complex green packaging chain.

When product price and perceived product quality are equal, consumers will be increasingly turning to these eco- and alternative-use attributes as the deciding purchasing factor. Going forward, brands cannot afford to ignore this “ecologically friendly” purchasing driver as they develop their brand positioning and marketing strategies.

SIZE MATTERS

Families around the world are seeking value in larger container sizes for milk. Meanwhile, 39% of UK consumers would like to see a wider range of smaller bottles of alcoholic beverages. As evident by the 50% of health-conscious snackers saying they’d be willing to try a new product if it comes in a small, trial-size pack, as brands’ product portfolios grow, the ability to reach consumers in unique and time-shifting use occasions.

The photo above on the right features a smaller size lipstick package by Stowaway Cosmetics (photo by APieceofToastBlog)

PACKAGING MOBIL-UTION

There’s a revolution happening in mobile-engaged packaging. Mobile interactions will account for 64 cents of every U.S. dollar spent in retail stores by the end of 2015. But unlike the previous generation of mobile-enabled packaging – which included clunky QR and text codes, as well as often-disappointing augmented reality experiences – this time around, brand owners are tapping near-field communication (NFC) and bluetooth low-energy (BLE) as primary engagement technologies to deliver on the promise that so many first-generation mobile engagements either didn’t or couldn’t. Moving forward, as brands clamour for innovative ways to engage and connect with shoppers, the mobile environment will become the new front line in the battle to win consumers’ hearts, minds, and wallets.

ABOUT THE AUTHOR

David Luttenberger

A cross category and pan-regional look, included within are data that support the emergence and future impact of these trends, as well as examples that highlight the best consumer packaged goods (CPG) producers are delivering to consumers around the world. These trends are designed to inspire new ideas and provide insight and recommendations brands can put into practice in the coming weeks, months and years.

DIGITAL EVOLUTION

The unique capabilities of digital printing have captured the attention of retailers, brand owners, and packaging converters around the world. Brought into the global mainstream limelight by the tremendous success of Coca-Cola’s “Share a Coke” campaign, digital printing is capturing brands’ attention by creating opportunities to engage consumers on a local, personal, or even emotional level.

With 1 in 5 U.S. Millennials seeking custom or personalized packaging, and nearly one quarter of Chinese consumers indicating they would pay more for personalized soft drink packaging, digital printing is positioned to grow well beyond industry estimates that it’s already accounting for 10% of packaging decoration globally.

Mintel believes 2016 will be the tipping point for digital package printing, as brands and package converters begin to move beyond using digital primarily for limited editions and personalization, and begin to capitalize on its economic and speed-to-market advantages for mainstream package decoration.

NFC label-reading technology, shown in the photo above on the left.

PHENOMENAL FLEXIBLES

No longer is flexible packaging (specifically pouches) considered a compromise. Presently, 32% of consumers associate flexible packaging with being modern, and brands are tapping into flexibles’ nearly unparalleled decoration and marketing opportunities. Add to that the ability to incorporate nearly any functional component of flexibles’ rigid counterpart, and the result is 56% growth in the launches of CPG flexibles according to Mintel’s Global New Products Database (GNPD) between 2010 and 2014.

But at what point will flexible packaging, especially stand-up pouches, become non-differentiated? And what should brand owners be thinking about next?

In 2016 while brands will still be looking to pouches to capture consumers’ attention, the truly innovative brands will be looking to the next generation of rigid/flexible hybrids that offer functional and environmental benefits alongside great shelf presence.

SHOW ME THE GOODS

With the growing number of on-pack claims competing for shoppers’ attention, consumers are demanding more information about what they are buying but seeking less on-pack clutter that confuses their purchasing decisions. This is perhaps nowhere more apparent than in food, where 58% of UK consumers check ingredient information on product packaging and 76% are concerned about the use of artificial preservatives.

Clear and concise information about ingredients, functional product attributes, or even convenience and safety must be communicated with total transparency – a key responsibility brands and consumers are placing squarely on packaging. Looking ahead, the concepts of clean labeling and clear on-pack communication are set to converge.

MORE THAN “JUST” GREEN PACKAGING

Brands are searching for environmentally responsible packaging options, consumers are putting the onus on brands to do right by doing good by the Earth. The difficulty is that while consumers want it all, they generally aren’t willing to pay more to get it, and even basic recycling is too difficult for many.

Despite best efforts, package recycling is well below its potential, and most consumers don’t have a real understanding of what to do with compostable packaging. But what is beginning to resonate are two key initiatives: a focus on alternative package material sources and catering to the 63% of U.S. consumers who’ve stated that reusable and repurposable packaging is a key purchasing driver they see as being yet another link in the long and complex green packaging chain.

When product price and perceived product quality are equal, consumers will be increasingly turning to these eco- and alternative-use attributes as the deciding purchasing factor. Going forward, brands cannot afford to ignore this “ecologically friendly” purchasing driver as they develop their brand positioning and marketing strategies.

SIZE MATTERS

Families around the world are seeking value in larger container sizes for milk. Meanwhile, 39% of UK consumers would like to see a wider range of smaller bottles of alcoholic beverages. As evident by the 50% of health-conscious snackers saying they’d be willing to try a new product if it comes in a small, trial-size pack, as brands’ product portfolios grow, the ability to reach consumers in unique and time-shifting use occasions.

The photo above on the right features a smaller size lipstick package by Stowaway Cosmetics (photo by APieceofToastBlog)

PACKAGING MOBIL-UTION

There’s a revolution happening in mobile-engaged packaging. Mobile interactions will account for 64 cents of every U.S. dollar spent in retail stores by the end of 2015. But unlike the previous generation of mobile-enabled packaging – which included clunky QR and text codes, as well as often-disappointing augmented reality experiences – this time around, brand owners are tapping near-field communication (NFC) and bluetooth low-energy (BLE) as primary engagement technologies to deliver on the promise that so many first-generation mobile engagements either didn’t or couldn’t. Moving forward, as brands clamour for innovative ways to engage and connect with shoppers, the mobile environment will become the new front line in the battle to win consumers’ hearts, minds, and wallets.